Money is only a tool. It will take you wherever you wish, but it will not replace you as the driver. Ayn Rand

GENIUS Act may cement US dollar dominance in digital economy

The Genius Act could boost the US dollar's dominance in Web3 by enforcing 1:1 stablecoin backing and compliance, according to a Foresight Ventures report

A key piece of US stablecoin legislation awaiting a full Senate vote may emerge as a net positive for the US dollar’s dominance in the digital asset economy.

The Guiding and Establishing National Innovation for US Stablecoins (GENIUS) Act aims to set clear rules for stablecoin collateralization and mandate compliance with Anti-Money Laundering laws.

The passing of the bill may solidify the US dollar’s leading position in the Web3 economy, according to a May 29 report by Foresight Ventures.

By requiring that stablecoins are backed 1:1 to the US dollar, the GENIUS Act reinforces the dollar’s role as the “world’s digital settlement currency,” the report stated. It also allows fintech companies to develop “compliant, secure and user-centric financial solutions,” said Zac Tsui, investment director at Foresight Ventures.

The bill passed a Senate procedural vote on May 20 by a 66–32 margin. However, industry observers remain cautious ahead of the final floor vote, particularly after the bill failed to gain support from key Democrats earlier in May.

Genius Act may pave the way for global crypto regulations

Some industry watchers see the GENIUS Act as the first step for ushering in a unified set of crypto regulations worldwide, as other jurisdictions look to follow the regulatory moves of the world’s largest economy.

“When the US moves on stablecoin policy, the world watches,” Andrei Grachev, managing partner at DWF Labs and Falcon Finance, told Cointelegraph during the Chain Reaction daily X spaces show on May 20.

Stablecoins aren’t a crypto experiment anymore. They’re a better form of money. Faster, simpler, and more transparent than fiat,” he said.

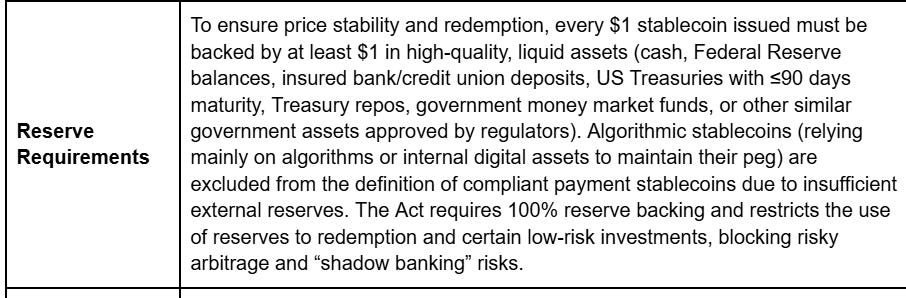

GENIUS Act reserve requirements. Source: Foresight Ventures

The bill aims to set clear guidelines for stablecoin issuers, prohibiting stablecoin reserve assets from being misappropriated or rehypothecated.

Stablecoin issuers could also be prohibited from using the reserve for “anything other than redemption and certain safe investments,” including low-risk instruments such as Treasury repos, to guard against “shadow banking” risks. via CoinTelegraph

Market Review & Top Crypto Movement for the Week

Check out Brave New Coins Market Cap

Weekly Bitcoin and Blockchain Statistics Infographic is based on 6 key metrics over the past 7 days

PODCASTS

Sign up for VConVC podcasts free summary newsletter upgrade for audio podcasts

Disclaimers:

Nothing written in this newsletter is legal or investment advice

Information is provided on a best-effort basis and is subject to change without prior notice. Be sure to verify everything you read